| DAILY ISSUE 2 “AI Filtered” Plays Every Investor Needs Now VIEW IN BROWSER Hello, Reader. When the mid-20th century photographer Elliott Erwitt remarked, “Be sure to take the lens cap off before photographing,” he was not speaking merely about taking pictures. Erwitt was advocating an open-eyed approach to life in general… First, take off the blinders; second, take action.

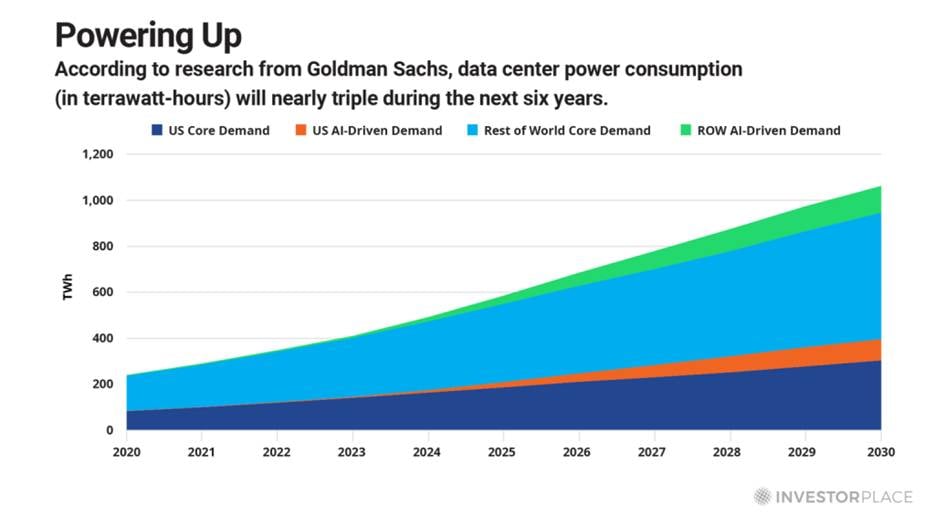

Too often, we investors attempt to make prudent investments without ever removing the lens caps over our critical perceptions. We forget to remove our biases, prejudices, and/or uninformed assumptions before committing our precious capital to a new investment. All of us have made this mistake at least once in our investment careers, which is why it is so important to double-check that nothing is obstructing our analytical abilities. This imperative is becoming increasing critical in the era of “everything AI.” Not only must we remove the lens cap, but we must also replace it with an “AI filter.” In other words, we need to view every new investment opportunity through the lens of artificial intelligence. AI-enabled technologies possess massive, long-term potential to transform almost every facet of life on planet Earth. They will reshape industries, reorganize the workforce, and, most importantly, redistribute wealth. Undoubtedly, many investors will try to capitalize by rushing like moths to a flame toward the hottest, hyped-up AI plays. That approach can work, but it’s easy to get burned, which is why I recommend a few alternative tactics. I’ve identified four distinct AI investment categories, each of which offers different levels of risk and reward. In today’s Smart Money, I’ll detail two of the categories and share a company for each. (I’ll share the next two categories in tomorrow’s Smart Money, so stay tuned.) From this day forward, every stock you consider should fall into one of these categories. This is the all-important “AI filter.” Now, let’s take a look through it… Category 1: Investing in AI Investing “in AI” simply means buying stock in companies that are creating the software and hardware architectures that enable AI technologies to operate and scale. These companies are building the highways, engines, and “brains” of AI, which includes cloud compute environments, high-performance databases, and scalable data architectures. This category contains the “obvious bets,” like Nvidia Corp. (NVDA), Microsoft Corp. (MSFT), Alphabet Inc. (GOOGL) , and Apple Inc. (AAPL ), as well as hundreds of hungry, well-financed upstarts. To succeed in this category, companies must spend billions of dollars to continuously innovate and fight for market share. No small task. That’s why picking winners in this hyper-competitive arena is risky. Today’s champion could easily become tomorrow’s cautionary tale. Advanced Micro Devices Inc. (AMD) is a clear “in AI” investment. Its cutting-edge data center GPU accelerators power the training and inference of the large language models (LLMs) that enable AI applications. This company is an AI “builder.” AMD’s Instinct MI350X series, launching later this quarter, is designed to rival – and in some cases outperform – the most advanced Blackwell chips from Nvidia. AMD offers comparable or better AI performance with greater memory capacity at a lower cost, giving it a significant pricing edge in a market hungry for efficient AI compute. This value proposition is already resonating with top-tier customers: Seven of the 10 largest AI model builders – including OpenAI, Meta Platforms Inc. (META), Microsoft, and xAI – are running production AI workloads on AMD hardware. This brings me to my second category… | Recommended Link | | | | The time to start selling large tech stocks may finally be upon us. On September 16th, experts are saying there is a 95% probability that an adverse event will hit megacap tech stocks. Futurist Eric Fry’s most renowned skill is picking which stocks to sell and what to buy during stock market “regime changes” just like this. Now, Eric is saying “Sell NVDA, AMZN and TSLA before it’s too late.” Get the names and tickers of the alternative stocks he suggests instead… |  | | Category 2: Investing Alongside AI Rather than creating AI technologies themselves, these companies support AI’s explosive growth from behind the scenes. They supply the physical materials, energy, real estate, and/or infrastructure required to build and operate AI systems. Although AI may seem like an invisible, nebulous force, it cannot work its magic without millions of physical servers humming along inside the world’s data centers 24 hours a day. And these millions of servers cannot be built and operate without a vast supporting cast like the… - Mining companies that unearth essential base and precious metals

- Real estate firms that provide suitable land

- Specialized construction companies that build data centers and related facilities

- Electric utilities or captive energy sources that deliver reliable power

These “enabler” companies are the “shovel sellers” of the AI gold rush. Nvidia’s CEO, Jensen Huang, predicts tech companies will spend at least $1 trillion on AI infrastructure over the next four years. Enabler companies will capture most of those dollars. Although Oracle Corp. (ORCL) invests billions of dollars to develop cutting-edge AI technologies, it operates primarily as an “Alongside AI” company. It is a world-leading AI “enabler.” The company’s Oracle Cloud Infrastructure (OCI) supports AI platforms and solutions across the entire tech ecosystem. OCI is purpose-built to support compute-heavy tasks like AI training, model deployment, and massive database management. Even Oracle’s cloud competitors, like Microsoft Azure, Google Cloud, and Amazon Web Services (AWS), have embraced Oracle’s technology in order to serve their own customers. Rather than choosing sides in the battle between Microsoft/OpenAI, Amazon, and Google, Oracle quietly powers them all. This “Switzerland” approach means Oracle doesn’t just benefit when one cloud wins… it benefits as the overall AI ecosystem expands. And speaking of benefiting… Remove the Investing Lens Cap In the past, investors rarely considered how future-proof a company might be. We didn’t worry about a disruptive force like AI sweeping across the global economy and rewriting the rules of almost every industry. We focused on fundamentals like market share, earnings growth, and dividends. But that sort of analysis is no longer sufficient to prepare for the world that lies ahead. To recall the words of Elliot Erwitt, “remove the lens cap” and invest with your eyes wide open. To aid in this endeavor, I want to share two more companies that fit within my “in” and “alongside” AI categories with you today. One is a company that uses AI software to control robots tailor-made for warehouses and distribution centers. The other, a company that quietly built the backbone of the internet and is now manufacturing the fiber-optic cables needed to run AI data centers. I reveal these companies, along with several others, in my free “Sell This, Buy That” broadcast, so you can add them to your portfolio immediately. “Removing the lens cap” also means that knowing which stocks to avoid is just as important as knowing which stocks to invest in. That is why, in this free broadcast, I also share four names that I believe are “Sells” These are companies facing significant AI headwinds that could drag down your portfolio. Click here to learn more. Regards, |