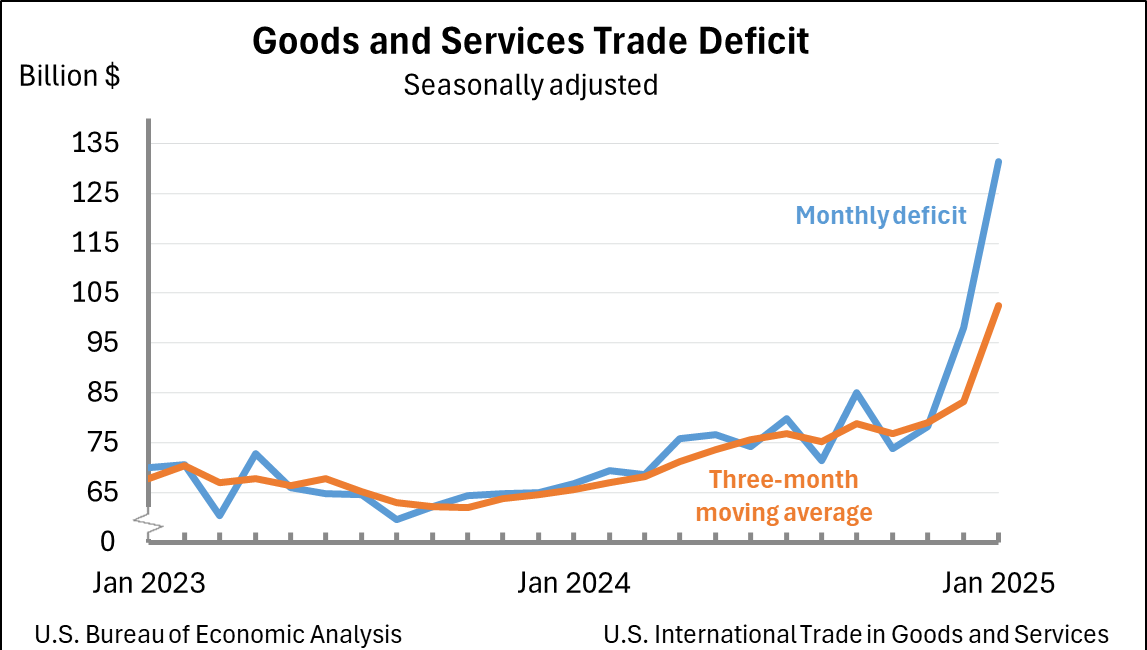

To support our work please consider becoming a paid subscriber to EconVue+ Bringing the Penguins to the Negotiating TableTariffs, Populism, and the Fracturing of the Global Economic OrderKarim Pakravan has been a regular contributor to econVue since 2016, focusing on global trade and international finance. econVue is committed to offering expert analysis and diverse viewpoints, curated to inform and engage readers. Please join the conversation! I. The Populist War on the Rules-Based SystemPresident Trump’s systematic dismantling of the global trade system entered a new phase on April 2, aka “Liberation Day”, when he unveiled his proposed reciprocal tariff on all U.S. trading partners. Among those targeted by these tariffs is an island close to the Antarctic populated only by penguins, for good measure! These tariffs were derived from a crude formula (country by country ratio of imports to bilateral trade deficit) that had little to do with reciprocity or economic reality. The unveiling of the Liberation Day measures quickly translated to a market panic, leading to a global stock market slump reminiscent of the 1987 stock market crash and turmoil on the bond markets, reviving the fears of stagflation. Major investment banks have upped the probability of a recession to 60% (Goldman Sachs) and even 79% (by JP Morgan). Market uncertainty was heightened by the typical Trump chaos that accompanied the introduction of these tariffs, with members of the Trump administration and the President himself issuing slews of contradictory messages. Are the tariffs here to stay? Were they designed as opening gambits to trade negotiations, or were they designed to revive America’s manufacturing base? Or perhaps they were designed to raise revenue to finance personal and corporate tax cuts. The tariffs were supposed to be implemented on April 9. As of this writing, Trump has backed off, delaying the implementation of reciprocal tariffs by 90 days (with the exception of China, which now will enjoy a 125% levy). Considerable uncertainty remains, as we do not know what moves to expect after the end of the 90-day reprieve. These trade policies represent the apotheosis of Trump’s forty-year crusade against the international trade system. Trump’s promotion of crude mercantilism sees global economic relations as a zero-sum game, reinforced by the perception that America has been victimized systematically by the rest of the world. What is Mercantilism? ⧉Trump would not have been able to garner the political support for these actions without the populist revolt in the United States and other major western countries against globalization. This revolt is the result of several decades of deindustrialization in the U.S. and other major economies, and the offshoring of manufacturing from these economies to lower cost locations, in particular China. However, globalization and free trade are not the only culprit in the loss of manufacturing in the advanced economies: technology and the neglect of investment in infrastructure and human capital are equally to blame. The question to ask is whether tariffs are the solution. In the mid-20th century, tariffs were justified by some economists to protect so-called infant industries to allow them to develop and become competitive. However, such theories were soon discredited. Furthermore, we do not have any infant industries in the United States that would need protection. Moreover, global trade has been carried on the basis of comparative advantage, with each country focusing on exporting goods and services where they have a comparative cost advantage. For example, the U.S. exports agricultural products, high tech and entertainment, while Indonesia exports sneakers and mining products. There is no precedent for tariff protection across every single industry. Tariffs could also be used to address unfair trade practices; however, such issues are usually addressed through trade negotiations. We should also note that many countries, such as Germany, have remained industrial powerhouses without tariff protection, although German exports did benefit from the European currency union. What Is Comparative Advantage? ⧉Regardless of the short and medium term impact of the new tariffs on financial markets, they are the first steps in the Trump administration’s determination to destroy the global rules-based trade and financial architecture that has underpinned the global system for the past 80 years. However, contrary to the beliefs of President Trump and his isolationist advisors and followers, the collapse of the present system will end up weakening and isolating the United States. II. Why the Current System Still MattersFirst, let us address the victimhood thesis promoted by Trump. Contrary to his rhetoric, the system of global alliances and rules-based global trade and financial system has been an essential pillar of the prosperity and influence of the United States in the past decades.

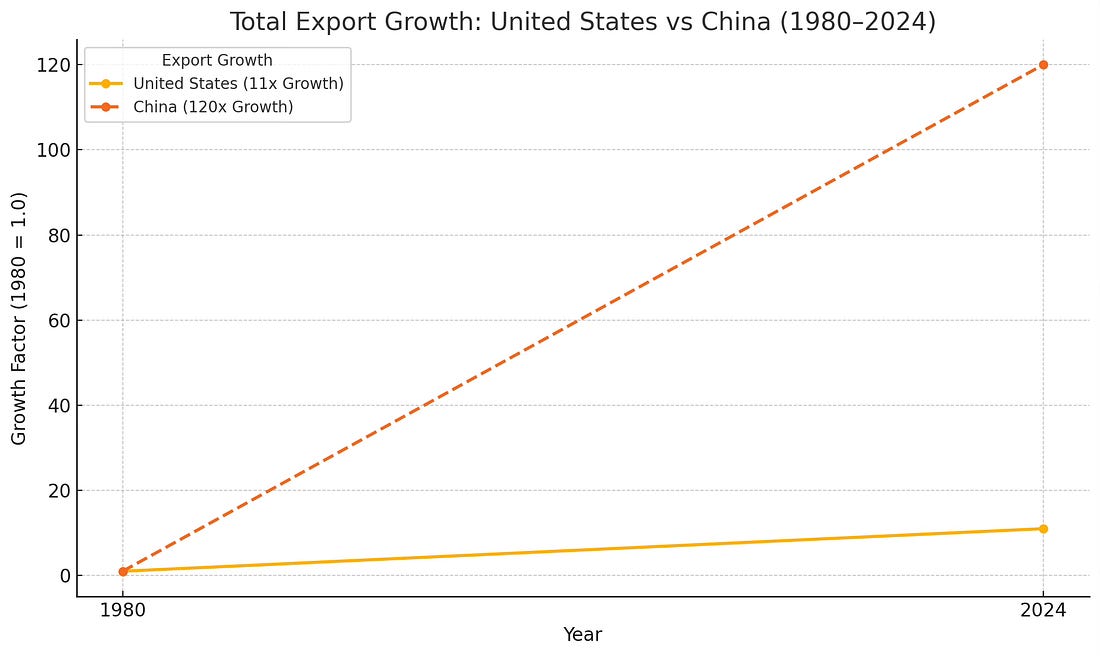

Finally, the “exorbitant privilege” of having the main international currency has allowed the U.S. to run chronic balance of payments and fiscal deficits, financed by foreign financial flows to the U.S. capital market—essentially a no-limit credit card for the country. By one estimate, the flow of foreign capital to the U.S. government bond markets has saved the U.S. government $100 billion a year in interest costs. III. The Shift Toward a Multipolar WorldAt the same time, the global financial and trade architecture has evolved over the past two decades. We live in a multipolar world, with China becoming the world’s second largest economy and a dominant technology, manufacturing, trade and finance platform. Major middle powers such as Mexico, India, Brazil and South Africa are creating their own space. New Global South-centered institutions and alliances are challenging the Global North-centered global financial architecture. Furthermore, The neo-liberal/globalization economic paradigm that dominated economic thinking and policymaking after the financial crisis of 2008 is increasingly under attack from both the left and the right. In this context, the Trump administration’s economic isolationism and focus on tariffs is inherently incoherent. On one hand, the U.S. is bent on destroying a global system that has been a pillar of its prosperity and global influence. On the other, it is seeking to bully its trading partners into submission. Given the changes outlined above, the result of these policies is likely to undermine the U.S. position and leave it increasingly isolated:

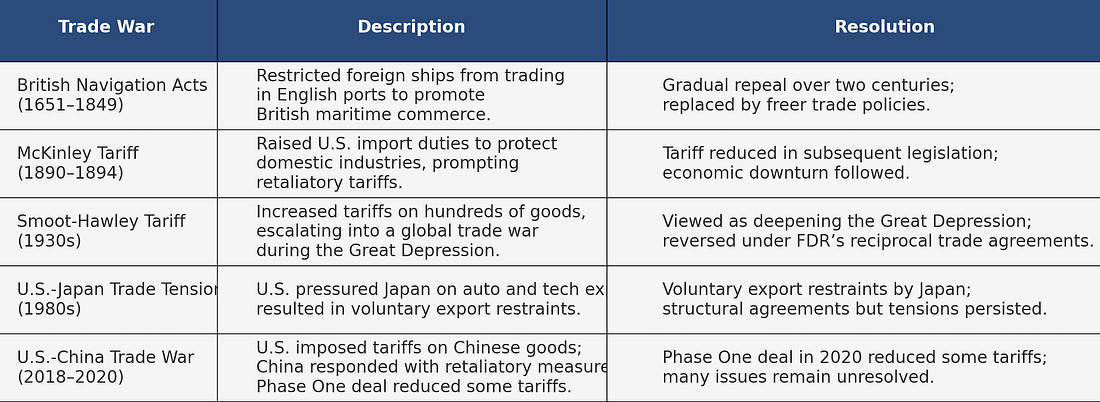

ConclusionThe chaotic actions of the first twelve weeks of the Trump administration, and what appear to be the first shots in a trade war, reflect an approach to trade policy that has been widely criticized as economically inconsistent or uninformed by mainstream economists such as former Treasury Secretary Larry Summers. The Hobbesian global order envisaged by Trump and his populist base is likely to lead to further global fragmentation, shifting the global balance of power to China, resulting in a poorer and more isolated United States. Historically, trade wars do not end well. Will the U.S. recalibrate its role in the global order—or continue down a path of fragmentation? 📍Chicago Follow Karim Pakravan here & on his blog: Random EconomicsMore on Tariffs on econVueExpert Voices. Global Focus. Informed Perspective.You're currently a free subscriber to econVue. For the full experience, upgrade your subscription. |

Bringing the Penguins to the Negotiating Table

April 13, 2025

0